IdealRatings ESG Model

The IdealRatings ESG Model provides a comprehensive framework to evaluate companies based on three core pillars: Environmental, Social, and Governance. Each pillar is divided into subcategories called Key Performance Indicators (KPIs), which consist of qualitative and quantitative inputs.

The model provides an insightful evaluation by combining qualitative insights with quantitative metrics, enabling consistent comparisons across industries and geographies.

Qualitative Segment

Metric Segment

How the Model Works?

IdealRatings employs a wide-ranging Materiality Assessment based on over 250 indicators across 21 KPIs, meticulously analyzed for their relevance to 160+ business activities. Through this assessment, KPIs are ranked by importance—categorized as High, Medium-High, Low-Medium, Low, or Irrelevant—and assigned weights specific to each business activity under the ESG pillars.

Environmental KPIs

- Air emissions

- Habitat protection

- Waste Management

- Environmental Management

- Water Resource Management

Social KPIs

- Supply Chain

- Human Capital

- Animal Welfare

- Consumer Protection

- Community Development

Governance KPIs

- Anti-corruption

- Anti-competitive

- Business Ethics

- Reporting & Transparency

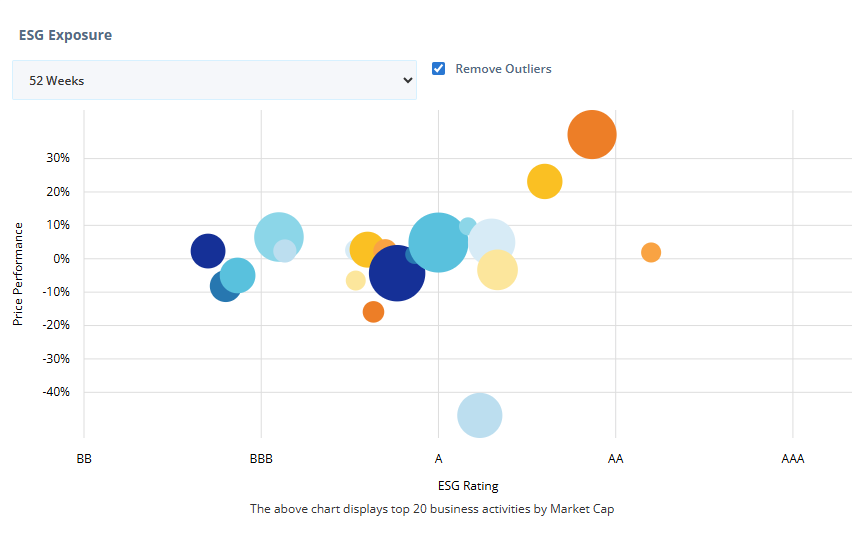

ESG Scores & Ratings Data Set

IdealRatings’ ESG Scores & Ratings Data set offers a distinct evaluation of a company’s sustainability performance, leveraging industry-specific materiality insights. By analyzing around 150 qualitative data points across the ESG pillars, we deliver ESG scores that support informed decision-making for responsible investments.

Sustainability Benchmarking

How It Works?

Standardized Scoring System

Yes

The information is explicitly available and meets the set definition A "Yes" response carries the full weight of the question.

No

The information is not mentioned in the references and/or does not meet the set definition. A "No" response carries zero weight.

In-conclusive

The information is referenced ambiguously or includes a vague statement that could imply "Yes" or "No." Other special cases where "Inconclusive" applies are explained in the question descriptions. An "Inconclusive" response carries half the weight of the question.

These inputs are grouped under their respective KPIs, each receiving a score based on the sum of the weights of its associated data elements. Utilizing the materiality and the research input, scores of KPIs within a pillar are summed to calculate the total pillar score, out of 100. Cumulative scores across all pillars are converted into an overall ESG score, presented as a standardized letter grade ranging from AAA (highest) to CC (lowest).

ESG Qualitative Data Set

IdealRatings’ ESG Qualitative Data set evaluates companies’ non-financial performance against proprietary sustainable investment guidelines and globally recognized standards. By integrating over 150 data points across ESG, we offer detailed insights to support sustainable investment decisions. (See our Materiality Assessment for additional details on industry-specific criteria.)

Sustainability Insights

ESG Integration

How It Works

International Norms

Companies are screened against a set of international norms that cover responsible investment guidelines. Among these guidelines:

SDGs, a collection of 17 global objectives outlined by the UN in 2015 for achievement by 2030, form a cornerstone of our evaluations. We scrutinize companies based on their contributions towards these goals. Through our platform, you can explore a breakdown of companies actively supporting SDGs, their specific alignments with individual goals, and those whose community initiatives are mapped against the 17 objectives. This meticulous mapping of corporate endeavors to the UN goals fosters a deeper understanding of sustainability efforts.

The UN Global Compact presents non-binding guidelines urging businesses worldwide to embrace and disclose the implementation of sustainable and socially responsible policies. Encompassing ten principles spanning human rights, labor, environment, and corruption, the UNGC is a pivotal framework. Our platform regularly updates the list of UNGC signatories, and non-signatory companies are diligently evaluated against these principles.

Crafted and proclaimed by the UN in 1948, the UDHR as a beacon for global human rights standards. Comprising 30 essential articles, the UDHR forms a critical benchmark. IdealRatings has aligned these articles with targeted inquiries to verify companies' compliance with these fundamental norms. Our service offers insights into companies upholding the UDHR and its associated provisions, ensuring a focus on adherence to the 30 core human rights articles.

Established nearly a century ago under the UN's auspices, the ILO advocates for justice and decent labor standards globally. While historically applied at a national level, these standards have gained prominence within corporate codes of conduct due to violations at the organizational level. IdealRatings assesses companies against ILO standards and relevant criteria, making information on adherence readily accessible through our platform for your convenience.

ESG Metric Data Set

Carbon Footprint Analysis

Benefits

Portfolio Construction

Identify securities with strong ESG performance to build robust, sustainable portfolios.

Pre-Trade Analytics

Screen investments for compliance with ESG thresholds across the E, S, and G pillars.

Risk and Violation Assessment

Mitigate reputational and compliance risks by identifying adherence or non-compliance with global standards like UNGC and SDGs.

Compliance Tracking

Monitor adherence to regulatory and sustainability targets for improved alignment with market expectations.

Attribution and Alpha Analysis

Analyze ESG compliance to derive alpha opportunities and support performance screening.

Benchmarking and Comparisons

Evaluate tangible ESG metrics and qualitative performance across industries, geographies, and peer groups.