Shariah-compliant Equity Screening Solution

Assess Shariah compliance across asset classes with unmatched depth and precision using our proprietary methodologies and patented screening engine.

Compliance Reporting

Support institutional transparency, regulatory alignment, and Shariah board engagement through robust, auditable reporting tools.

Unlock the potential of Shariah ETFs

Offer detailed screening of constituents, accurate business activity and purification metrics, streamlined data feeds for ETF management, and uncompromising benchmark validation.

Zakat Calculation for Investment Portfolios

Enables investors to calculate Zakat accurately, quickly, and efficiently on their assets, investments, and diverse portfolios. This saves them time and effort, allowing them to focus on their investment strategies and portfolio management while ensuring compliance with Shariah rules and regulations in different countries.

Purification

Traditional purification methods can be time-consuming and may not always provide the precision needed for today's dynamic markets.

At IdealRatings, we've developed a one-of-a-kind solution that empowers fund managers to purify their funds and portfolios with unprecedented accuracy and frequency – whether it's weekly, monthly, or quarterly.

Our inimitable research methodology allows for the calculation of an exact purification value, giving you a clear and precise understanding of your holdings.

This level of accuracy has a direct and positive impact on your fund's overall returns, ensuring both ethical compliance and strong financial performance.

- Purify more frequently

- Achieve unparalleled accuracy

- Optimize fund returns

- Streamline Shariah compliance

A Robust Approach to Compliant REITs

A comprehensive qualitative approach to screen REIT instruments against Shariah principles. The universe consists of 850+ listed REIT across more than 35 nations covering all types of REITs including commercial, offices, residential and industrial REITs.

IdealRatings utilizes a comprehensive research process, analyzing financial statements, investor presentations, and market reports to accurately determine REITs' Shariah compliance by assessing portfolio mix, major tenants, and their non-permissible income contribution.

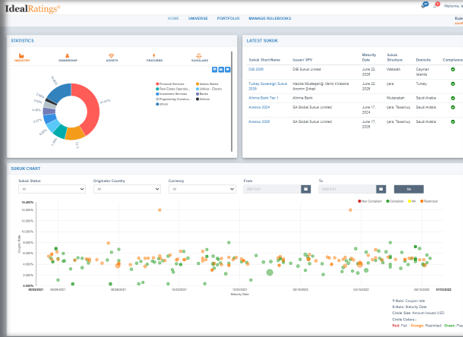

The First-Ever Customizable Sukuk Screening Engine

Empowers Shariah auditors, asset managers, and treasuries to import their specific guidelines and screen the global Sukuk universe against both institutional and market standards. This innovative tool ensures accurate Shariah compliance, covers diverse Sukuk structures, and provides comprehensive financial and legal details.

Customize Sukuk Mandate

Easily customize your Sukuk mandates to match your unique requirements. This includes:

Wide Range of Indexes

Out of its extensive experience in Shariah and Financial screening, IdealRatings has partnered with the top index providers worldwide to present unique indexes that cater to the benchmarking needs of asset and fund managers, and as well to cover the multiple asset classes and territories.

Furthermore, IdealRatings calculates custom Shariah indexes for mutual funds and financial institutions as per their own guidelines and mandate.

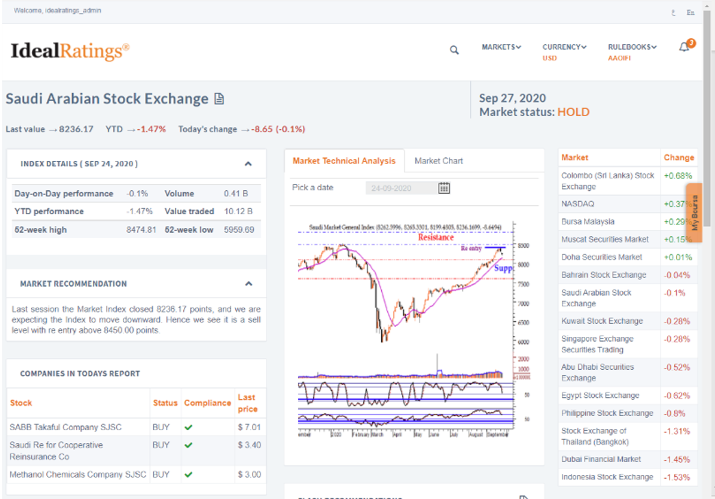

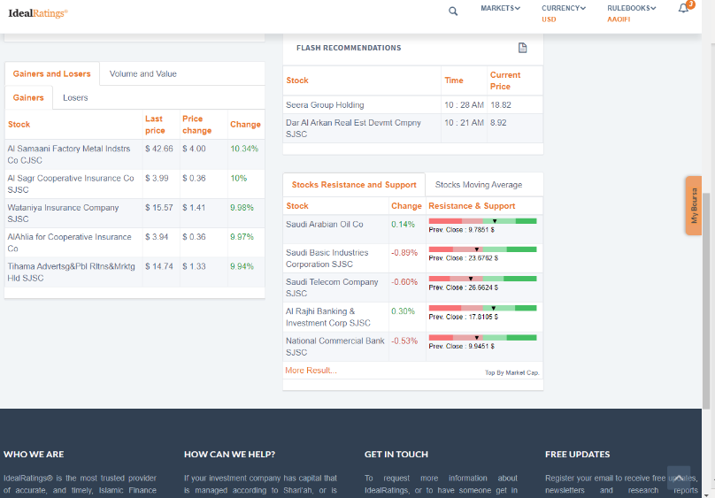

Sell Side

An intuitive solution designed to cater to the needs of institutional brokerage and individual stock market investors. The bi-lingual web-based solution offers its users a comprehensive coverage of stock markets performance, statistics and indicators along with a through daily technical analysis by a distinguished team, who provides daily recommendations for 15 different markets.

Further, the solution includes stock screening, purification, peer stock analysis, market performance indicators and market highlights

The data set is fully customizable, where organizations selectively create the set of data and features appealing to their individual clients and can further develop and add their custom data gadgets onto the platform.

IdealRatings services are designed to have multiple delivery options, ranging from full integration, data-feed to plug-n-play.

Optimizing Your Private Asset Data

The availability of updated information for private companies naturally varies. IdealRatings addresses this by offering coverage through designated universes.