Sustainability Simplified

IdealRatings Regulatory Reporting Data Set helps organizations in navigating the dynamic landscape of sustainability regulations and reporting requirements. This comprehensive data set not only facilitates adherence to regulatory standards but also effectively mitigates issues surrounding greenwashing.

Sustainable Finance Disclosure Regulation (SFDR)

In line with the EU Sustainable Action Plan, the EU Commission enforced its SFDR regulation in 2021. The aim of this Directive is increasing The SFDR aims at increasing transparency in sustainable investment practices. It requires financial market participants and advisors to disclose how sustainability risks are integrated into their processes and products, helping investors make informed decisions.

Principal Adverse Impact (PAI)

Articles 8 & 9 Alignment

EU Taxonomy

Among the plans to fulfill its Sustainable Action plan, the European Commission imposed the EU Taxonomy in 2022. This classification system defines environmentally sustainable economic activities.

It sets clear criteria for identifying activities that significantly contribute to climate and environmental goals; while ensuring they do no significant harm to other objectives and comply with minimum safeguards.

Unlock EU Taxonomy Alignment

IdealRatings’ EU Taxonomy Data Set offers an inclusive solution to help companies align with the European Commission’s sustainability-related action plan and reporting requirements.

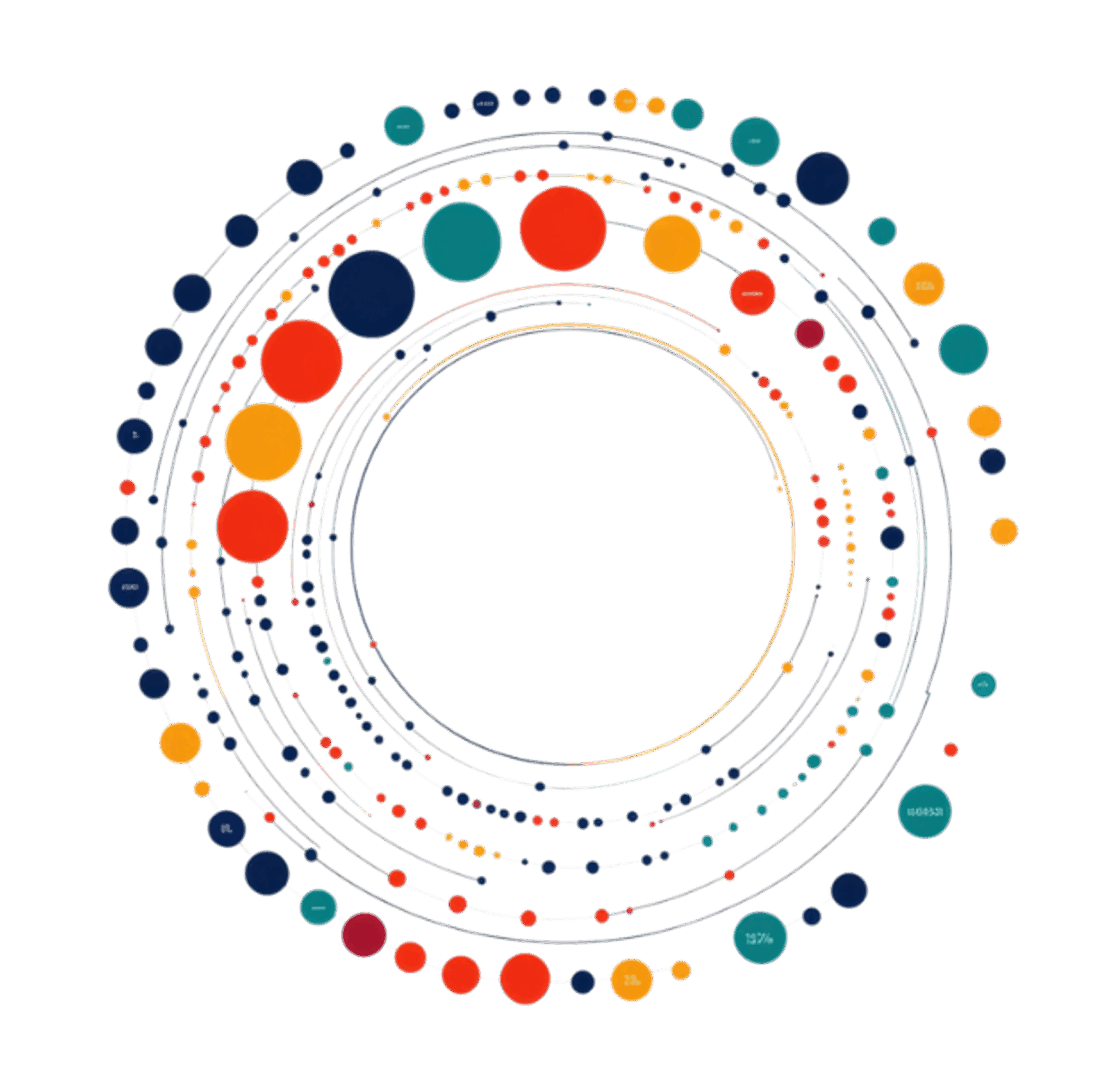

Our EU Taxonomy Model has been created using the Taxonomy’s guidance encompassing 4 key steps to reach each economic activity’s alignment.

Based on this model, IdealRatings can provide our esteemed clients with:

Percentages Disclosure

Turnover, CAPEX, and OPEX eligibility and alignment percentages. These figures are detailed for each economic activity as well as at the company-wide level.

Performance Assessment

Evaluating companies’ disclosures on TSC, DNSH, and Minimum Safeguards and assigning performance levels of High, Medium, and Low.

Granular Data

Provides raw data elements, for TSC, DNSH, and Minimum Safeguards, upon which performance assessment levels were derived.

European ESG Template (EET)

Empowers organizations to navigate the complex landscape of European sustainability regulations with confidence and clarity, ensuring seamless integration of ESG compliance into business operations.

Benefits

Unified Reporting and Compliance

Address overlaps between SFDR, EU Taxonomy, and EET frameworks to streamline ESG reporting.

Principal Adverse Impact Tracking

Monitor and report mandatory PAI indicators to meet SFDR requirements.

Activity Alignment

Evaluate company operations and disclosures against EU Taxonomy environmental objectives.

Regulatory and Internal Reporting

Facilitate comprehensive reporting on sustainability risks and financial metrics like Revenue, CAPEX, and OPEX.

Data Integration

Embed regulatory reporting data into internal systems for operational ease and accuracy.